Καλώς Ήρθατε στην 3Κ Investment Partners

Η 3K Investment Partners είναι ανεξάρτητη εταιρεία διαχείρισης αμοιβαίων κεφαλαίων. Προσφέρουμε ένα ευρύτατο φάσμα διαφορετικών τύπων αμοιβαίων κεφαλαίων, που καλύπτει όλους τους επενδυτικούς προσανατολισμούς, ενώ παράλληλα δίνουμε τη δυνατότητα δημιουργίας εξατομικευμένων χαρτοφυλακίων. Σκοπός μας είναι η παροχή υψηλής ποιότητας επενδυτικών υπηρεσιών προστιθέμενης αξίας

Αξίζει να δεις

Μετοχικό

Το 3K Greek Value Μετοχικό Εσωτερικού επενδύει σε Ελληνικές Επιχειρήσεις που πετυχαίνουν δυνητικά εξαιρετικές αποδόσεις σε μακροπρόθεσμο ορίζοντα, έχουν έντονη εξαγωγική δραστηριότητα, υγιείς ισολογισμούς, χρηματική ρευστότητα, κερδοφορία και κυρίως αξιόπιστες, σταθερές και χρηστές διοικήσεις, δίνοντας ιδιαίτερη έμφαση σε επιχειρήσεις που δύνανται να κρύβουν σημαντικές αξίες.

Περισσότερα

Income

Ομολογιακό

Το 3K International Income Ομολογιακό προσφέρει μια έξυπνη λύση σε όλους όσοι θέλουν τα χρήματά τους να έχουν την προοπτική να επιτύχουν υψηλότερες αποδόσεις από τις προθεσμιακές καταθέσεις. Το χαρτοφυλάκιό του υπόκειται σε διαρκείς προσαρμογές στο συνεχώς μεταβαλλόμενο περιβάλλον, προκειμένου να επιτύχει τους στόχους του.

Περισσότερα

Investing

Funds

Οι «Υπεύθυνες Επενδύσεις» (Responsible Investing) σας δίνουν την ευκαιρία να επενδύσετε σε διεθνείς επενδυτικές στρατηγικές συμβάλλοντας παράλληλα στη βελτίωση της ζωής στον πλανήτη.

Οι επενδύσεις “Responsible Investing” σας προσφέρουν αποτελεσματική διαχείριση του κεφαλαίου και δυνητικά την επίτευξη καλύτερων μακροπρόθεσμων αποδόσεων

Patrimonial

Defensive

Αποκτήστε ένα χαρτοφυλάκιο με αξίες απ’ όλο τον κόσμο, με μετριοπαθές «προφίλ» αξιοποιώντας τις ευκαιρίες στις διεθνείς αγορές. Δώστε ευελιξία και δύναμη στο κεφάλαιό μέσω της συνεχούς επαγγελματικής διαχείρισης που ασκούν τα εξειδικευμένα στελέχη της Goldman Sachs Asset Management και στοχεύστε μέσω του μετριοπαθούς προφίλ και της διασποράς στην παγκόσμια οικονομία σε αποδόσεις υπέρτερες των καταθέσεων, σε βάθος χρόνου.

ΠερισσότεραΒιωσιμότητα & Υπεύθυνες Επενδύσεις

Είναι καθήκον μας να σχεδιάζουμε το μέλλον και να λειτουργούμε προς όφελος των μακροπρόθεσμων συμφερόντων τόσο των πελατών μας, όσο και του ευρύτερου κοινωνικού συνόλου. Η βιωσιμότητα αποτελεί μέρος της αποστολής μας και της ευθύνης μας για ένα καλύτερο αύριο.

Eπισκεφθείτε την υπηρεσία της 3Κ Investment Partners!

- Αποκτήστε πρόσβαση σε πλήθος αγορών μέσα από μία ευρεία γκάμα αμοιβαίων κεφαλαίων και ΟΣΕΚΑ

- Δημιουργήστε και διαμορφώστε τα χαρτοφυλάκιά σας άμεσα και εύκολα

- Ενημερωθείτε ανά πάσα στιγμή για την πορεία της επένδυσής σας

Υπηρεσία Διαχείρισης Χαρτοφυλακίων

Βασιζόμενοι στην εμπειρία και εξειδίκευση των στελεχών της Εταιρείας μας, αξιολογούμε τις χρηματοοικονομικές απαιτήσεις του κάθε υποψήφιου επενδυτή και σε συνδυασμό με το επενδυτικό του προφίλ, προτείνουμε τη διαμόρφωση ενός χαρτοφυλακίου επενδύσεων το οποίο ανταποκρίνεται στις ανάγκες του. Το χαρτοφυλάκιο αυτό παρακολουθείται και προσαρμόζεται βάσει των αλλαγών που συντελούνται τόσο στις χρηματοοικονομικές ανάγκες του επενδυτή όσο και στο γενικότερο οικονομικό περιβάλλον, σε εγχώριο και διεθνές επίπεδο.

Αναλύσεις & Άρθρα

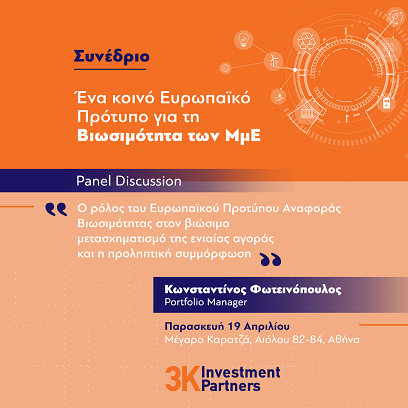

Παγκόσμια Ημέρα της Γυναίκας

Συνέντευξη του Γιώργου Κουφόπουλο στο Euro2Day - Τι προτείνει στους επενδυτές για το 2024

Νέο Ομολογιακό Αμοιβαίο Κεφάλαιο από τη 3Κ Investment Partners και την Attica Bank

H 3K Investment Partners και η Attica Bank, στο πλαίσιο της στρατηγικής τους συνεργασίας διαθέτουν στο κοινό μία ακόμα λύση για την αποδοτική αξιοποίηση των χρημάτων των επενδυτών. Το Αμοιβαίο Κεφάλαιο 3K/Τράπεζα Αττικής Premier Income Ομολογιακό 2026 δίνει τη δυνατότητα στους πελάτες να αξιοποιήσουν τα τρέχοντα υψηλά επιτόκια στις αγορές ομολόγων και να επιτύχουν δυνητικά υψηλότερη απόδοση από τα τρέχοντα επιτόκια των τραπεζικών καταθέσεων.

Ακούστε το νέο μας podcast.

.jpeg)