Author: NN Investment Partners

The revival of the reflation theme in the markets since September has already faded somewhat as it is alternating again with the determined search for yield amongst investors. An asset class with exposure towards both themes is real estate; hence we upgraded the sector to a medium overweight position.

Real estate is exposed towards both the search for yield and the reflation theme. In an environment of decent growth but low interest rate risk, real estate generally performs well.

Disappointing inflation data feed the search for yield

The September US inflation report was disappointing as the core CPI number was flat at 1.7% year-on-year. Many investors had been looking forward to the report on US consumer price inflation and hoped to find confirmation that price pressures were finally rebounding. Also Eurozone inflation failed to pick up; core inflation fell to 1.1% year-on-year in September from 1.2%. After a soft patch in global inflation trends in the first half of the year, the summer period brought back some life to inflation dynamics. As economic growth remained healthy and, in recent weeks, also positive economic data surprises moved upwards, the reflation theme revived somewhat in global markets. Bond yields rose, inflation expectations moved up somewhat and cyclical equities where star performers. At least, until signs emerged that the upward momentum in inflation might be stalling yet again.

The inflation reports were probably a key reason why we observed a shift in the underlying investment themes, whereby the reflation and cyclical trade has made room for a more balanced one which also favours the search for yield. Bond yields declined and credit markets performed strongly. In equity markets we saw a shift away from the cyclical sectors towards more defensive parts of the market. Especially the “bond proxies’ did well, with the utilities and real estate sectors outperforming the broader market.

It therefore looks like we are still in an environment where both the reflation theme and the search for yield theme are alternating. Key variables in this respect are the macroeconomic data, which continue to surprise on the upside across all regions, and the trend in bond yields, which looks to be depressed by the weak inflation numbers and the anticipation of very gradual monetary policy tightening. The latest inflation data did however not have any meaningful impact on the view that the Fed will hike interest rates in December. Overall, we expect an additional two hikes in 2018 and in the Eurozone a lower-for-longer QE program with the first rate hike only forecasted by Q2 2019.

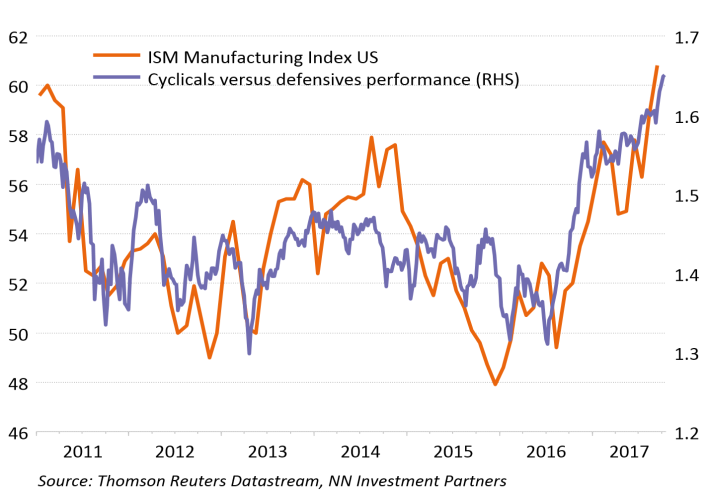

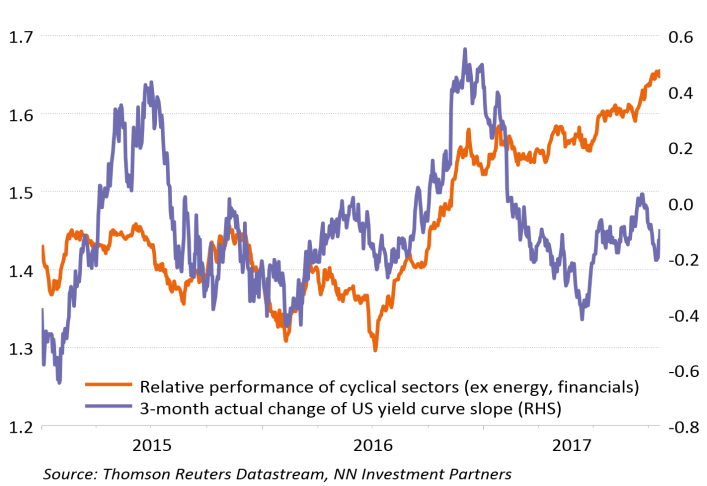

The two charts below illustrate the dichotomy we are currently in. Macroeconomic data point towards an overweight in cyclical sectors, whereas the most recent shift in the US yield curve points towards a more defensive outcome.

Macroeconomic data point to cyclical strength

US yield curve and cyclical sectors

Source: Thomson Reuters Datastream, NN Investment Partners

We maintain the cyclical bias in our equity sector allocation through overweight positions in IT, energy and industrials. This view is based on the strong fundamental picture, while we still expect bond yields to move gradually higher on the back of a pick-up in inflation and gradually tighter monetary policy. Stable to rising commodity prices also play a role. This environment would also be supportive for the financial sector, our preferred sector, given its low valuation and positive correlation with bond yields. We keep underweight positions in yield plays such as utilities and defensive sectors like consumer staples and telecom services.

Real estate: exposure to growth and the search for yield

An asset class that has exposure towards both the search for yield and the reflation theme is real estate. In an environment of decent growth but low interest rate risk, real estate generally performs well. In times like these, real estate is often preferred by investors to other asset classes due to its bond-like characteristics (carry benefits) while also having the inflation compensation aspect.

This could make the macroeconomic climate of 2017 an environment that could have been beneficial to the asset class and to be preferred by investors. However, it has not yet proven to be the case. It can be partly explained by understanding some of the structural headwinds the asset class is facing. For example, headwinds such as the shift from brick & mortar stores towards e-commerce and ‘flex working’ which decreases the demand for office space both have negatively impacted the listed real estate sector significantly.

Year-to-date, there is a performance difference of about 25%-points between the least performing sector (Retail REIT) and the top performing sector (Industrial REIT). This is mainly caused by the significant differences in the fundamentals of the sectors. As said, Retail REITs have been struggling due to the shift towards online shopping, where Industrial REITs have been gaining as they own and manage distribution centres and warehouses.

From a top down perspective, we see that the macroeconomic data are strong and better than expected. This is supportive for real estate. Looking at the interest rate environment, the risk of a rapid rise in interest rates still looks limited given the lack of inflation, but a rising rate environment in combination with record low credit spreads could create headwinds.

An additional element currently supporting the real estate sector is the high short positioning in US real estate, which at 6% is close to the highest level over the past three years. At the same time, the dividend premium on top of Euro investment grade credit of 3.6% is the highest in more than 10 years. These two elements make us believe that part of the structural headwinds is already discounted for. The cyclical tailwinds (growth in retail sales, positive labour market trends, high confidence indicators, etc.) from their side are still present.

Given this backdrop, we decided to upgrade the real estate asset class from a small overweight to a medium overweight in our tactical asset allocation.

.png)