We actively participate for a better future

At 3K Investment Partners we operate in accordance with the principles and standards imposed by the institutional sustainability framework, but above all and beyond these we seek to fulfill our mission with reliability, responsibility, transparency and respect for the needs of customers and of all those affected by the operation of our company.

We also align ourselves with international standards and best practices, both in applying criteria to evaluate our products and investments, and in partnering with our stakeholders in the context of transitioning to a sustainable business model.

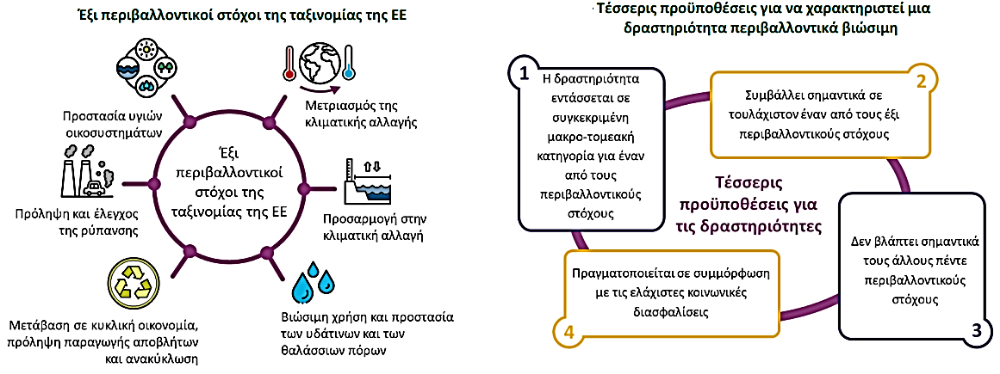

After all, from 1/1/2022 the European Taxonomy for the climate crisis is applicable mandatorily. In addition, based on the Regulation (EU) 2019/2088 (SFDR), the company is obliged to inform its clients about the inclusion of sustainability risks in the process of making investment decisions and providing investment advice.

.png)