Author: NN Investment Partners

As we look ahead to 2017, we can see growing geopolitical risks, fears over migration, the threat of European fragmentation and the spread of populism. But we also see the global economy heading into the new year in better shape than it has been in for past 10 years.

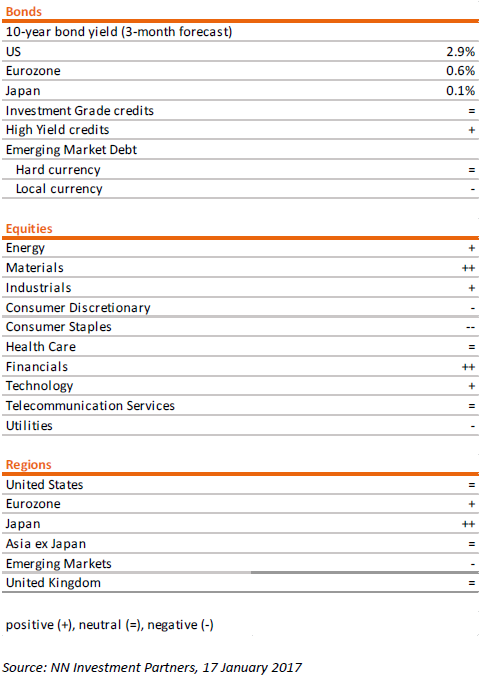

Political risks in the US or Europe, hawkish central banks or renewed emerging market worries are just a few of the uncertainty factors that could move markets this year. For now, though, the underlying economy is guiding us toward a growth-oriented mind set. We have increased the risk tilt in our asset allocation.

One of the lessons of 2016 was that politics is not the only thing that matters for markets. Many of us were caught off guard by last year’s political surprises and perhaps even more so by the market’s reactions to them. The Brexit vote and the US election could not stop the market from realizing that the global economy was actually and convincingly improving and that it was heading into the new year in its best state of the last decade. Unemployment rates are at cyclical lows, household and corporate confidence is at cyclical highs and leading indicators for the business cycle are pointing up in a synchronized way across the globe.

Meanwhile, investors remain rich in cash and/or bonds, two asset classes that probably offer the weakest expected returns since the 1930s. Investor sentiment has jumped higher in response to stronger GDP and earnings growth expectations. And since excessive positioning or contrarian technical signals are no longer visible for most risky assets, it made sense to further upgrade our risk tilt by adding to both equities and real estate in recent weeks.

Equities were upgraded to a small overweight. The fundamental indicators linked to the economy and earnings are positive. The short-term technicals have come off a bit and are no longer in overbought territory. Hence our decision to move equities up again to a small overweight. We upgraded real estate from a medium to a large overweight. Investors sometimes forget the important cyclical component present in this asset class. In the short term, a strong rise in bond yields could act as a drag on this asset class, but we think this risk is limited and will happen against a background of strong economic fundamentals.

You will find the whole article by clicking here

.png)